Employee Benefits & Administration

Signum is a

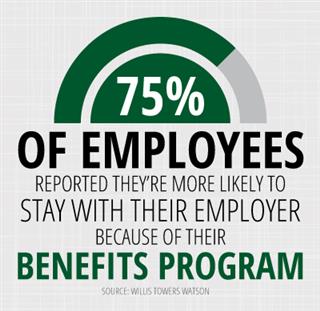

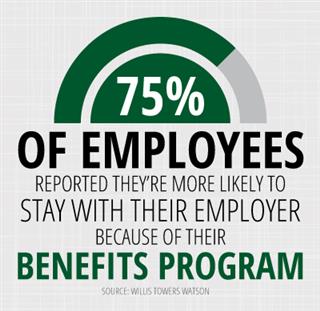

Professional Employer Organization (PEO) providing full-service human resources (HR) consulting and support to companies throughout South Carolina, North Carolina, Georgia, and the Southeast. When it comes to employee benefits, we know that business owners want to be able to offer their employees a comprehensive benefits package. However, this is sometimes very difficult due to high rates as well as the fact that small and mid-sized businesses are often times not privy to the same employee benefit opportunities as large corporations.

This is where partnering with

Signum HR can be very helpful. We routinely offer benefits at a lower premium while providing access to other types of benefits that may not be easily accessible on your own. In addition, with Signum, not only can you offer your employees insurance benefits at a great cost, you can also extend these benefits to spouses, children, and dependents. We offer access to the following employee benefits including, but not limited to:

- Health Insurance

- Life Insurance

- Dental Insurance

- Vision Insurance

- Short and Long-Term Disability Insurance

- Accident Insurance

- Cancer Insurance

- Critical Illness Insurance

- 401K Retirement Plans

- And Much More!

These are just a few of the benefits that Signum can help a small or mid-sized business owner obtain at an affordable rate for their employees.

Expert Assistance in Obtaining the Best Benefit Packages

Our expert, professional staff will sit down with you to discuss the benefit needs specific to your business. We will then create a comprehensive strategy to plan, design, and source your employee benefits based on the type of benefits you want to offer your employees at the best rates available.

PPACA Guidance and Compliance

The Patient Protection and Affordable Care Act (PPACA) is the landmark health reform legislation that was passed by Congress and signed into law in March 2010. The legislation includes a long list of health-related provisions that began taking effect in 2010. The PPACA contains comprehensive health insurance reforms and includes tax provisions that affect individuals, families, businesses, insurers, tax-exempt organizations, and government entities. The law also contains benefits and responsibilities for other organizations and employers. The size and structure of your workforce determines your responsibility.

The PPACA is extremely complex and provides specific guidelines regarding employer requirements for offering health insurance, the cost or affordability of health insurance, as well as mandatory reporting, just to name a few. The PPACA also specifies substantial financial penalties for not complying with the law. By partnering with

Signum HR, you will be provided with the proper guidance and support for making the best health insurance decisions for your company, while ensuring compliance with the PPACA.

ERISA

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established pension and health plans in private industry to provide protection for individuals in these plans.

ERISA requires plans to provide participants with plan information including important information about plan features and funding, sets minimum standards for participation, vesting, benefit accrual and funding, provides fiduciary responsibilities for those who manage and control plan assets, and much more.

By enlisting Signum as your HR partner, you could save significant stress, unnecessary trouble, and possible fines while being able to provide your employees with a comprehensive and compliant benefits package.

Contact us today to get started!

Signum is a Professional Employer Organization (PEO) providing full-service human resources (HR) consulting and support to companies throughout South Carolina, North Carolina, Georgia, and the Southeast. When it comes to employee benefits, we know that business owners want to be able to offer their employees a comprehensive benefits package. However, this is sometimes very difficult due to high rates as well as the fact that small and mid-sized businesses are often times not privy to the same employee benefit opportunities as large corporations.

This is where partnering with Signum HR can be very helpful. We routinely offer benefits at a lower premium while providing access to other types of benefits that may not be easily accessible on your own. In addition, with Signum, not only can you offer your employees insurance benefits at a great cost, you can also extend these benefits to spouses, children, and dependents. We offer access to the following employee benefits including, but not limited to:

Signum is a Professional Employer Organization (PEO) providing full-service human resources (HR) consulting and support to companies throughout South Carolina, North Carolina, Georgia, and the Southeast. When it comes to employee benefits, we know that business owners want to be able to offer their employees a comprehensive benefits package. However, this is sometimes very difficult due to high rates as well as the fact that small and mid-sized businesses are often times not privy to the same employee benefit opportunities as large corporations.

This is where partnering with Signum HR can be very helpful. We routinely offer benefits at a lower premium while providing access to other types of benefits that may not be easily accessible on your own. In addition, with Signum, not only can you offer your employees insurance benefits at a great cost, you can also extend these benefits to spouses, children, and dependents. We offer access to the following employee benefits including, but not limited to: